When I was in Sunnyvale in 2005 November, the vast majority of people who were buying million dollar houses were no-hablo-english hispanics on foodstamps with no regular job buying houses no money down. As far as I could tell, every person buying a house for over a million dollars was an unemployed underclass non white. Earlier there had been some whites buying, but by November, anyone with a credit rating or an employment history had given up on buying or was trying to sell.

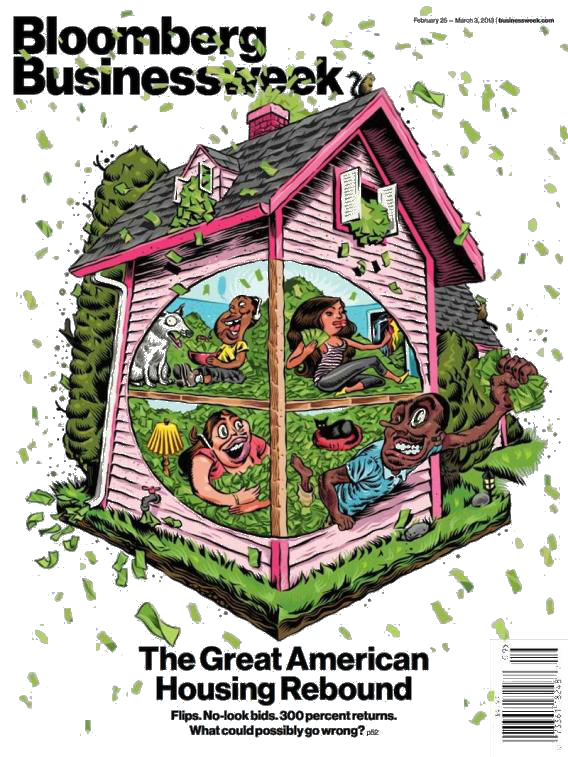

I don’t have any direct evidence that Bloomberg’s cover accurately displays the way things are now, but it accurately displays what I saw with my own eyes in Sunnyvale California in November 2005. It was million dollar welfare handouts back then, and I doubt that things have improved under Obama.

You may ask who gets to lose the money this time around. The answer, this time around, is instead of the fed indirectly, it is the fed directly. Instead of bailing out those who irresponsibly buy mortgage backed securities, it has been buying mortgage backed securities directly – which means those who foolishly treat dollars as money will, eventually, be those paying.

The pile of hundred dollar bills that the dog is using for its bed were freshly printed up by the federal reserve, which obtained in exchange mortgage backed securities, hence reports no loss. Indeed, it has reported no loss on any of the very large pile of mortgage backed securities that it now owns, even though, for the most part, no one has made any payments on the mortgages underlying those securities. This is your off the books deficit, which outweighs the on the books deficit to the same degree as off the books welfare outweighs on the books welfare – your deficit, in the sense that if you are one of America’s rapidly diminishing minority of taxpayers, people think you are going to pay it. You are going to be making that dog’s bed.

Mestizos in California drive cars even though no one really expects them to have a driving license or third party insurance, and not all of them know how to drive a car. To deny them the right to drive a car by imposing white centric standards of licensing on them would be raaaaciiisssst. Similarly, expecting them to make payments on the mortgage would be raaaaciiisssst.

Equality before the law obviously is not equal if the law reflects white behavior. And so, equality before the law quietly transforms into statistically equal impact of the law. Expecting mestizos to make mortgage payments would impact them more severely than it impacts whites. Mestizos are a voting majority in California. Californian blacks, who are a voting minority, still need to pay their mortgages and get driver’s licenses. Theoretically Hispanic privilege extends to all Hispanics, to anyone who claims to be Hispanic, and that is federal law and practice, but suspiciously white looking Hispanics find that they do not get some of the more outrageous Hispanic California state privileges. Now that Hispanics have a majority in California, it is becoming harder to qualify as one of this privileged group.

[…] Bloomberg speaks truth to power « Jim’s Blog […]

[…] Most of our suppose Real GDP, which Moldbug calls Fudged GDP, is makework, of negative value. See a devastatingly accurate depiction of the FIRE […]